🍃 NTPC Share Price Target 2025, 2030 to 2050 with Analysis

🕰️30 Seconds Summary🕰️

Beyond power generation, NTPC actively contributes to social and environmental causes through various corporate social responsibility (CSR) initiatives, including education, healthcare, and community development.

About NTPC Share (BSE & NSE : NTPC)

| Company Name | National Thermal Power Limited |

| Stock Exchange | NSE, BSE |

| Ticker Symbol | NTPC |

| Sector | Energy |

| Headquarter | New Delhi |

| Founded in | 1975 |

| Major Shareholder | Govt. of India (~52%) |

| Market Cap. | INR 3.27 Trillion (₹ 3,270,000,000,000) |

| Revenue(2023) | INR 167,725 crore |

| Listing date | BSE & NSE on November 05, 2004 |

| Nifty50 weightage | 0.99% |

| Sensex weightage | 1.76% |

| Competitors / Peers | Power Grid, Adani Power, Tata Power, Reliance Power, JSW Power |

| All-time high price | 448.30 (Sept 30, 2024) |

| 52-week high | 448.30 (Sept 30, 2024) |

| 52-week low | 305.75 (Mar 15, 2024) |

NTPC Share Price Analysis : SHORT & LONG TERM

Chart analysis of NTPC Share Price

One year chart analysis of NTPC Share Price

Here, in one year NTPC share price chart, we can clearly see that on December 31, 2023 it closed its year at the price of ₹311.15 & now in the end of the year 2024, it is trading on ₹ 333.25 (December 20, 2024) showing only a return of +7.10%.

NTPC share price traded in a slight uptrend in 2024 till September showing a month-on-month gain of 2-3%. NTPC hit its 52-week high of 448.30 on September 30,2024, a gain of +43.68% on its year’s opening price. BUT after hitting its 52-week high, NTPC share price started coming down. In October, November & December, NTPC share lost its value by -25.66%, as it is trading on ₹ 333.25.

NIFTY, SENSEX & NTPC : A comparative analysis

Since NTPC is a part of both NSE’s NIFTY index as well as BSE’s SENSEX index, it always remains in sync with the index. Looking at the comparative chart above, we can clearly see the sync in up and downs of both NTPC & Sensex. BUT, there is a catch. Do you think NSE’s Nifty Index & BSE’s Sensex gave the same returns as given by NTPC (+7.10%) ? Let’s find out.

| Year | Nifty | Sensex | NTPC |

|---|---|---|---|

| 2024 | +8.54% | +8.03% | +7.10% |

| 2023 | +20.03% | +18.74% | +86.93% |

| 2022 | +4.33% | +4.44% | +33.80% |

| 2021 | +24.12% | +21.99% | +25.21% |

| 2020 | +14.90% | +15.75% | -16.55% |

In 2020, due to COVID pandemic there is a huge divergence between Indices & NTPC. Although after 2020, NTPC share outperformed both Nifty & Sensex with huge margin in 2022 and 2023. Keep reading, below we have the long term price analysis.

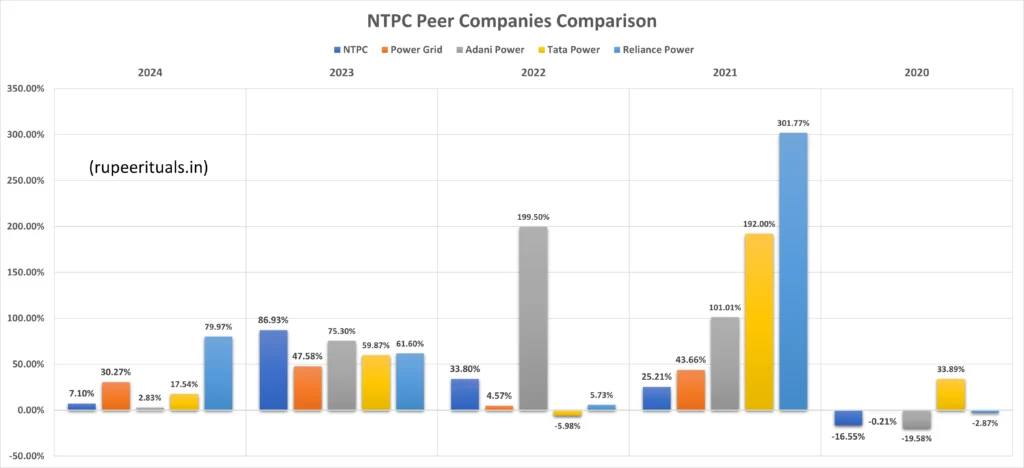

NTPC Peer Comparison / Competitors Analysis

In this section, we will compare NTPC to its top competitors. We will analyze how other companies performed year-on-year . Below is the comparative table of NTPC, Power Grid, Adani Power, Tata Power, Reliance Power’s returns from 2020 to 2024 based on CLOSING Prices.

| Year | NTPC | Power Grid | Adani Power | Tata Power | Reliance Power |

|---|---|---|---|---|---|

| 2024 | +7.10% | +30.27% | +2.83% | +17.54% | +79.97% |

| 2023 | +86.93% | +47.58% | +75.30% | +59.87% | +61.60% |

| 2022 | +33.80% | +4.57% | +199.50% | -5.98% | +5.73% |

| 2021 | +25.21% | +43.66% | +101.01% | +192.00% | +301.77% |

| 2020 | -16.55% | -0.21% | -19.58% | +33.89% | -2.87% |

| Average Returns | +27.30% | +25.17% | +71.81% | +59.46% | +89.24% |

Here we can observe that Reliance Power is the clear winner if we look at the 5-year average returns. Power Grid & Adani Power also gave massive returns to the patient investors.

NTPC Share Price Long term analysis

| Year | High | Low | Close | % change |

|---|---|---|---|---|

| 2020 | 125.00 | 73.20 | 99.35 | –16.55 |

| 2021 | 152.10 | 88.15 | 124.40 | +25.21 |

| 2022 | 182.95 | 123.65 | 166.45 | +33.80 |

| 2023 | 315.50 | 162.55 | 311.15 | +86.93 |

| 2024 | 448.45 | 296.55 | 333.25 | +7.10 |

From the above data we can observe that in previous 5 years, NTPC shares gave tremendous returns to its patient investors. If we consider the returns ever after taking average inflation rate of 6% per annum in account, it can be considered as DECENT returns (ROI). Now we know about the historical price change, its time to look at how NTPC share can behave in coming days. Let’s analyze it on different timeframes.

Time-Frame analysis of NTPC : Hourly, Daily & Weekly

As by a simple timeframe chart analysis we can observe the following about NTPC share price –

Since NTPC share is not only trading below all the SMAs (except 100 Week & 200 Week) BUT if we observe closely, the SMAs are also trending in downwards direction (BEARISH Trend). So, if you are thinking about investing in NTPC’s shares, it will be advisable that you should wait for some time & invest only when the share prices & SMAs change their trend from bearish to sideways or Bullish.

In the right / below(mobile), you can see the current suggestions of experts about how the NTPC share may behave in coming days.

National Thermal Power Corporation’s (NTPC) Fundamental Indicators

| Indicator | Value | Interpretation |

|---|---|---|

| Net Profit/Share (in Rs.) | 18.64 (Mar 24)- 4.88% increase | NTPC’s Net profit / Share ratio was 17.73 (March 23). This has also shown a little improvement as compared to previous year. |

| Cash Earning-per-Share (EPS) | 33.02 (FY24) – 5.56% increase | NTPC’s cash EPS has been improved from 31.28 Rs. |

| Debt-to-Equity (D/E) ratio | 1.0 (FY24) | NTPC’s D/E ratio is improved if we compare it with previous years 1.3(FY23). |

NTPC Share Price Targets : SHORT & LONG TERM

NTPC Share Price Target 2025, 2026, 2027, 2028, 2029

| Year | Share Price Target |

|---|---|

| 2025 | ₹ 437 |

| 2026 | ₹ 498 |

| 2027 | ₹ 570 |

| 2028 | ₹ 652 |

| 2029 | ₹ 747 |

By 2025, NTPC’s share price is expected to reach ₹437, representing a +31.13% increase from its current price of ₹333.25 (December 20, 2024). By 2026, the stock could rise further to ₹498, reflecting a +49.44% gain. In 2027, the share price is projected to climb to ₹570, marking a +71.04% increase.

Continuing its growth, the price might reach ₹652 by 2028, showing a +95.65% growth. Finally, by 2029, NTPC’s share price could hit ₹747, representing a +124.16% gain from today’s price. These projections suggest steady upward momentum, making National Thermal Power Corporation a strong prospect for long-term investors.

NTPC Share Price Target 2030, 2035, 2040, 2050

| Year | Stock Price Target |

|---|---|

| 2030 | ₹ 854 |

| 2035 | ₹ 1678 |

| 2040 | ₹ 3281 |

| 2050 | ₹ 12598 |

By 2030, NTPC’s share price is projected to reach ₹854, delivering a +156.26% return on its current price of ₹333.25 (December 20, 2024). Looking further ahead, by 2035, the stock could climb to ₹1678, representing a +403.53% gain. By 2040, NTPC’s share price is expected to rise to ₹3281, marking an +884.55% increase from today’s price.

Looking even further into the future, by 2050, the share price could soar to ₹12,598, indicating an impressive +3680.35% growth. These projections highlight NTPC’s long-term potential for substantial returns, making it an attractive choice for patient, growth-focused investors in the energy sector.

💡Is WAAREEENER a better share than NTPC ? Read this to find out…

NTPC Share Price Target for 2025 (month-wise)

NTPC Share Price Target for 2026 (month-wise)

NTPC Share Price Target for 2027 (month-wise)

🚘 Is Hyundai Motors India a free ride to profits ? Read this to find out…

Conclusion

Below we have picked 2 videos for you which can help you to understand more about NTPC’s future. Also don’t forget to check out our FAQs, you may find the answer of your query.🤑HAPPY INVESTING🤑.

Handpicked for you (Must Watch)

Frequently Asked Questions (FAQs)

-

✅ Is NTPC a good share to buy?

Honestly, as per our analysis, we think National Thermal Power Corp. (BSE, NSE : NTPC) is a very good company to keep in your portfolio. Since, it is has governments back support and consistently innovating in solar power generation, the future look bright for the company. As we are experiencing a boom in EVs demand, India will need more power generation in future.

-

✅ What is the target price of NTPC for 2025?

In 2025, we are expecting NTPC share price to reach ₹ 437 which is a 31.13% return on today’s price of ₹ 333.25.

-

✅ Can we hold NTPC for long term?

Yes, as per our opinion if you are thinking of investing in energy sector or in renewable energy sector, then you can invest some part of that capital in the NTPC share.

-

✅ What is the NTPC share price target for 2050?

By 2050, the NTPC share price could reach around ₹ 12,598.

-

✅ What is the NTPC share price target for 2040?

By 2040, the NTPC share price could reach around ₹ 3,281.

-

✅ What is the NTPC share price target for 2030?

As per our analysis, NTPC share price may hit a high of ₹854 in 2030.

Disclaimer : Not an Investment Advice

The content shared in the article “NTPC Share Price Target 2025, 2030 to 2050 with Analysis” is for general information only. It’s not intended as financial, investment, or professional advice. Always consult a qualified professional—whether legal, financial, or tax-related—before making any investment decisions.

7 Comments